Free Statistics

of Irreproducible Research!

Description of Statistical Computation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Author's title | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Author | *The author of this computation has been verified* | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| R Software Module | Patrick.Wessarwasp_pairs.wasp | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

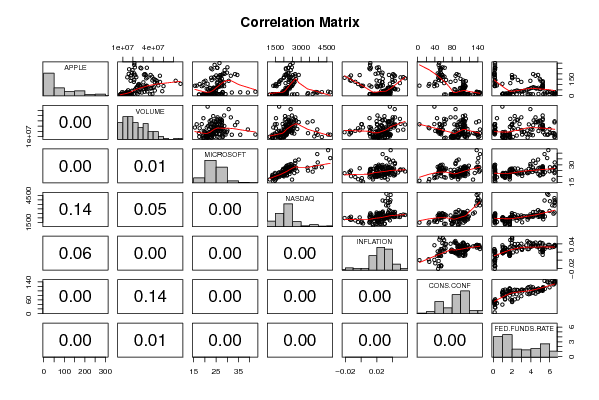

| Title produced by software | Kendall tau Correlation Matrix | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Date of computation | Sat, 11 Dec 2010 15:52:20 +0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cite this page as follows | Statistical Computations at FreeStatistics.org, Office for Research Development and Education, URL https://freestatistics.org/blog/index.php?v=date/2010/Dec/11/t1292082973eaahac2i8fgk2d9.htm/, Retrieved Sat, 02 Aug 2025 18:07:36 +0000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Statistical Computations at FreeStatistics.org, Office for Research Development and Education, URL https://freestatistics.org/blog/index.php?pk=108230, Retrieved Sat, 02 Aug 2025 18:07:36 +0000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| QR Codes: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Original text written by user: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IsPrivate? | No (this computation is public) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| User-defined keywords | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estimated Impact | 104 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tree of Dependent Computations | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Family? (F = Feedback message, R = changed R code, M = changed R Module, P = changed Parameters, D = changed Data) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - [Kendall tau Correlation Matrix] [] [2010-12-05 17:44:33] [b98453cac15ba1066b407e146608df68] - R PD [Kendall tau Correlation Matrix] [WS10 Pearson] [2010-12-11 15:52:20] [aa6b599ccd367bc74fed0d8f67004a46] [Current] - PD [Kendall tau Correlation Matrix] [WS10 Pearson] [2010-12-13 13:35:44] [afe9379cca749d06b3d6872e02cc47ed] F RM D [Kendall tau Correlation Matrix] [workshop 10 1] [2010-12-14 19:47:39] [a90833f600c49a37df2affa5b2163a2e] - RMPD [Kendall tau Correlation Matrix] [workshop 10 2] [2010-12-14 19:50:15] [a90833f600c49a37df2affa5b2163a2e] - RMPD [Recursive Partitioning (Regression Trees)] [workshop 10 3] [2010-12-14 19:58:44] [a90833f600c49a37df2affa5b2163a2e] - RMPD [Recursive Partitioning (Regression Trees)] [workshop 10 3] [2010-12-14 20:06:16] [a90833f600c49a37df2affa5b2163a2e] - RMPD [Recursive Partitioning (Regression Trees)] [workshop 10 3] [2010-12-14 20:06:16] [a90833f600c49a37df2affa5b2163a2e] F RMPD [Recursive Partitioning (Regression Trees)] [workshop 10 3] [2010-12-14 20:06:16] [a90833f600c49a37df2affa5b2163a2e] - [Recursive Partitioning (Regression Trees)] [verbetering WS 10 3] [2010-12-17 15:58:28] [033eb2749a430605d9b2be7c4aac4a0c] - [Recursive Partitioning (Regression Trees)] [] [2010-12-21 21:01:55] [9b13650c94c5192ca5135ec8a1fa39f7] - [Recursive Partitioning (Regression Trees)] [] [2010-12-21 23:28:42] [dd4fe494cff2ee46c12b15bdc7b848ca] - RMPD [Recursive Partitioning (Regression Trees)] [workshop 10 4] [2010-12-14 20:06:16] [a90833f600c49a37df2affa5b2163a2e] - D [Kendall tau Correlation Matrix] [Paper - Pearson c...] [2010-12-21 10:45:37] [18fa53e8b37a5effc0c5f8a5122cdd2d] - P [Kendall tau Correlation Matrix] [Paper - Kendall's...] [2010-12-21 10:59:27] [18fa53e8b37a5effc0c5f8a5122cdd2d] - D [Kendall tau Correlation Matrix] [] [2010-12-24 14:58:49] [69c775ce4d55db2aa75a88e773e8d700] - RM [Kendall tau Correlation Matrix] [WS10 Pearson corr...] [2012-12-06 14:02:50] [74be16979710d4c4e7c6647856088456] - RM [Kendall tau Correlation Matrix] [WS 10 Pearsoncorr...] [2012-12-10 16:49:18] [74be16979710d4c4e7c6647856088456] - RM [Kendall tau Correlation Matrix] [] [2012-12-11 23:24:04] [74be16979710d4c4e7c6647856088456] - RM [Kendall tau Correlation Matrix] [] [2012-12-11 23:27:29] [74be16979710d4c4e7c6647856088456] - RMPD [Kendall tau Correlation Matrix] [Workshop 10: Pear...] [2012-12-12 00:25:38] [081ff4808467d7c84e980fa7f896f721] - PD [Kendall tau Correlation Matrix] [WS10 Kendall Tau] [2010-12-13 13:40:02] [afe9379cca749d06b3d6872e02cc47ed] - RM [Kendall tau Correlation Matrix] [WS10 Kendall's Ta...] [2012-12-06 14:10:22] [74be16979710d4c4e7c6647856088456] - RM [Kendall tau Correlation Matrix] [WS 10 Kendall tau...] [2012-12-10 19:08:57] [74be16979710d4c4e7c6647856088456] - RM [Kendall tau Correlation Matrix] [] [2012-12-11 23:30:17] [74be16979710d4c4e7c6647856088456] - RMP [Kendall tau Correlation Matrix] [Workshop 10: Kend...] [2012-12-12 00:43:44] [081ff4808467d7c84e980fa7f896f721] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Feedback Forum | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Post a new message | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Dataset | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dataseries X: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

25.94 23688100 39.18 3940.35 0.02740 144.7 5.45 28.66 13741000 35.78 4696.69 0.03220 140.8 5.73 33.95 14143500 42.54 4572.83 0.03760 137.1 5.85 31.01 16763800 27.92 3860.66 0.03070 137.7 6.02 21.00 16634600 25.05 3400.91 0.03190 144.7 6.27 26.19 13693300 32.03 3966.11 0.03730 139.2 6.53 25.41 10545800 27.95 3766.99 0.03660 143.0 6.54 30.47 9409900 27.95 4206.35 0.03410 140.8 6.5 12.88 39182200 24.15 3672.82 0.03450 142.5 6.52 9.78 37005800 27.57 3369.63 0.03450 135.8 6.51 8.25 15818500 22.97 2597.93 0.03450 132.6 6.51 7.44 16952000 17.37 2470.52 0.03390 128.6 6.4 10.81 24563400 24.45 2772.73 0.03730 115.7 5.98 9.12 14163200 23.62 2151.83 0.03530 109.2 5.49 11.03 18184800 21.90 1840.26 0.02920 116.9 5.31 12.74 20810300 27.12 2116.24 0.03270 109.9 4.8 9.98 12843000 27.70 2110.49 0.03620 116.1 4.21 11.62 13866700 29.23 2160.54 0.03250 118.9 3.97 9.40 15119200 26.50 2027.13 0.02720 116.3 3.77 9.27 8301600 22.84 1805.43 0.02720 114.0 3.65 7.76 14039600 20.49 1498.80 0.02650 97.0 3.07 8.78 12139700 23.28 1690.20 0.02130 85.3 2.49 10.65 9649000 25.71 1930.58 0.01900 84.9 2.09 10.95 8513600 26.52 1950.40 0.01550 94.6 1.82 12.36 15278600 25.51 1934.03 0.01140 97.8 1.73 10.85 15590900 23.36 1731.49 0.01140 95.0 1.74 11.84 9691100 24.15 1845.35 0.01480 110.7 1.73 12.14 10882700 20.92 1688.23 0.01640 108.5 1.75 11.65 10294800 20.38 1615.73 0.01180 110.3 1.75 8.86 16031900 21.90 1463.21 0.01070 106.3 1.75 7.63 13683600 19.21 1328.26 0.01460 97.4 1.73 7.38 8677200 19.65 1314.85 0.01800 94.5 1.74 7.25 9874100 17.51 1172.06 0.01510 93.7 1.75 8.03 10725500 21.41 1329.75 0.02030 79.6 1.75 7.75 8348400 23.09 1478.78 0.02200 84.9 1.34 7.16 8046200 20.70 1335.51 0.02380 80.7 1.24 7.18 10862300 19.00 1320.91 0.02600 78.8 1.24 7.51 8100300 19.04 1337.52 0.02980 64.8 1.26 7.07 7287500 19.45 1341.17 0.03020 61.4 1.25 7.11 14002500 20.54 1464.31 0.02220 81.0 1.26 8.98 19037900 19.77 1595.91 0.02060 83.6 1.26 9.53 10774600 20.60 1622.80 0.02110 83.5 1.22 10.54 8960600 21.21 1735.02 0.02110 77.0 1.01 11.31 7773300 21.30 1810.45 0.02160 81.7 1.03 10.36 9579700 22.33 1786.94 0.02320 77.0 1.01 11.44 11270700 21.12 1932.21 0.02040 81.7 1.01 10.45 9492800 20.77 1960.26 0.01770 92.5 1 10.69 9136800 22.11 2003.37 0.01880 91.7 0.98 11.28 14487600 22.34 2066.15 0.01930 96.4 1 11.96 10133200 21.43 2029.82 0.01690 88.5 1.01 13.52 18659700 20.14 1994.22 0.01740 88.5 1 12.89 15980700 21.11 1920.15 0.02290 93.0 1 14.03 9732100 21.19 1986.74 0.03050 93.1 1 16.27 14626300 23.07 2047.79 0.03270 102.8 1.03 16.17 16904000 23.01 1887.36 0.02990 105.7 1.26 17.25 13616700 22.12 1838.10 0.02650 98.7 1.43 19.38 13772900 22.40 1896.84 0.02540 96.7 1.61 26.20 28749200 22.66 1974.99 0.03190 92.9 1.76 33.53 31408300 24.21 2096.81 0.03520 92.6 1.93 32.20 26342800 24.13 2175.44 0.03260 102.7 2.16 38.45 48909500 23.73 2062.41 0.02970 105.1 2.28 44.86 41542400 22.79 2051.72 0.03010 104.4 2.5 41.67 24857200 21.89 1999.23 0.03150 103.0 2.63 36.06 34093700 22.92 1921.65 0.03510 97.5 2.79 39.76 22555200 23.44 2068.22 0.02800 103.1 3 36.81 19067500 22.57 2056.96 0.02530 106.2 3.04 42.65 19029100 23.27 2184.83 0.03170 103.6 3.26 46.89 15223200 24.95 2152.09 0.03640 105.5 3.5 53.61 21903700 23.45 2151.69 0.04690 87.5 3.62 57.59 33306600 23.42 2120.30 0.04350 85.2 3.78 67.82 23898100 25.30 2232.82 0.03460 98.3 4 71.89 23279600 23.90 2205.32 0.03420 103.8 4.16 75.51 40699800 25.73 2305.82 0.03990 106.8 4.29 68.49 37646000 24.64 2281.39 0.03600 102.7 4.49 62.72 37277000 24.95 2339.79 0.03360 107.5 4.59 70.39 39246800 22.15 2322.57 0.03550 109.8 4.79 59.77 27418400 20.85 2178.88 0.04170 104.7 4.94 57.27 30318700 21.45 2172.09 0.04320 105.7 4.99 67.96 32808100 22.15 2091.47 0.04150 107.0 5.24 67.85 28668200 23.75 2183.75 0.03820 100.2 5.25 76.98 32370300 25.27 2258.43 0.02060 105.9 5.25 81.08 24171100 26.53 2366.71 0.01310 105.1 5.25 91.66 25009100 27.22 2431.77 0.01970 105.3 5.25 84.84 32084300 27.69 2415.29 0.02540 110.0 5.24 85.73 50117500 28.61 2463.93 0.02080 110.2 5.25 84.61 27522200 26.21 2416.15 0.02420 111.2 5.26 92.91 26816800 25.93 2421.64 0.02780 108.2 5.26 99.80 25136100 27.86 2525.09 0.02570 106.3 5.25 121.19 30295600 28.65 2604.52 0.02690 108.5 5.25 122.04 41526100 27.51 2603.23 0.02690 105.3 5.25 131.76 43845100 27.06 2546.27 0.02360 111.9 5.26 138.48 39188900 26.91 2596.36 0.01970 105.6 5.02 153.47 40496400 27.60 2701.50 0.02760 99.5 4.94 189.95 37438400 34.48 2859.12 0.03540 95.2 4.76 182.22 46553700 31.58 2660.96 0.04310 87.8 4.49 198.08 31771400 33.46 2652.28 0.04080 90.6 4.24 135.36 62108100 30.64 2389.86 0.04280 87.9 3.94 125.02 46645400 25.66 2271.48 0.04030 76.4 2.98 143.50 42313100 26.78 2279.10 0.03980 65.9 2.61 173.95 38841700 26.91 2412.80 0.03940 62.3 2.28 188.75 32650300 26.82 2522.66 0.04180 57.2 1.98 167.44 34281100 26.05 2292.98 0.05020 50.4 2 158.95 33096200 24.36 2325.55 0.05600 51.9 2.01 169.53 23273800 25.94 2367.52 0.05370 58.5 2 113.66 43697600 25.37 2091.88 0.04940 61.4 1.81 107.59 66902300 21.23 1720.95 0.03660 38.8 0.97 92.67 44957200 19.35 1535.57 0.01070 44.9 0.39 85.35 33800900 18.61 1577.03 0.00090 38.6 0.16 90.13 33487900 16.37 1476.42 0.00030 4.0 0.15 89.31 27394900 15.56 1377.84 0.00240 25.3 0.22 105.12 25963400 17.70 1528.59 -0.00380 26.9 0.18 125.83 20952600 19.52 1717.30 -0.00740 40.8 0.15 135.81 17702900 20.26 1774.33 -0.01280 54.8 0.18 142.43 21282100 23.05 1835.04 -0.01430 49.3 0.21 163.39 18449100 22.81 1978.50 -0.02100 47.4 0.16 168.21 14415700 24.04 2009.06 -0.01480 54.5 0.16 185.35 17906300 25.08 2122.42 -0.01290 53.4 0.15 188.50 22197500 27.04 2045.11 -0.00180 48.7 0.12 199.91 15856500 28.81 2144.60 0.01840 50.6 0.12 210.73 19068700 29.86 2269.15 0.02720 53.6 0.12 192.06 30855100 27.61 2147.35 0.02630 56.5 0.11 204.62 21209000 28.22 2238.26 0.02140 46.4 0.13 235.00 19541600 28.83 2397.96 0.02310 52.3 0.16 261.09 21955000 30.06 2461.19 0.02240 57.7 0.2 256.88 33725900 25.51 2257.04 0.02020 62.7 0.2 251.53 28192800 22.75 2109.24 0.01050 54.3 0.18 257.25 27377000 25.52 2254.70 0.01240 51.0 0.18 243.10 16228100 23.33 2114.03 0.01150 53.2 0.19 283.75 21278900 24.34 2368.62 0.01140 48.6 0.19 300.98 21457400 26.51 2507.41 0.01170 49.9 0.19 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tables (Output of Computation) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Figures (Output of Computation) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Input Parameters & R Code | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Parameters (Session): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| par1 = 1 ; par2 = Do not include Seasonal Dummies ; par3 = No Linear Trend ; | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Parameters (R input): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| par1 = pearson ; | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| R code (references can be found in the software module): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

panel.tau <- function(x, y, digits=2, prefix='', cex.cor) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||